What Is Threshold Income. threshold income calculation. help and support what are you looking for? threshold and adjusted income are terms relevant to the tapered annual allowance. the standard personal allowance is £12,570, which is the amount of income you do not have to pay tax on. to calculate his threshold income, take his taxable pay of £279,500 and deduct his pension contribution of £14,000 to a group personal pension.

threshold and adjusted income are terms relevant to the tapered annual allowance. The threshold income has increased to £200,000 and the adjusted income. Maximum amount of income which is not chargeable to. What Is Threshold Income All, i am trying to work out what the threshold income is on the below. the threshold income, which is broadly net income before tax (excluding pension contributions), is increased from £110,000 to £200,000. threshold income calculation.

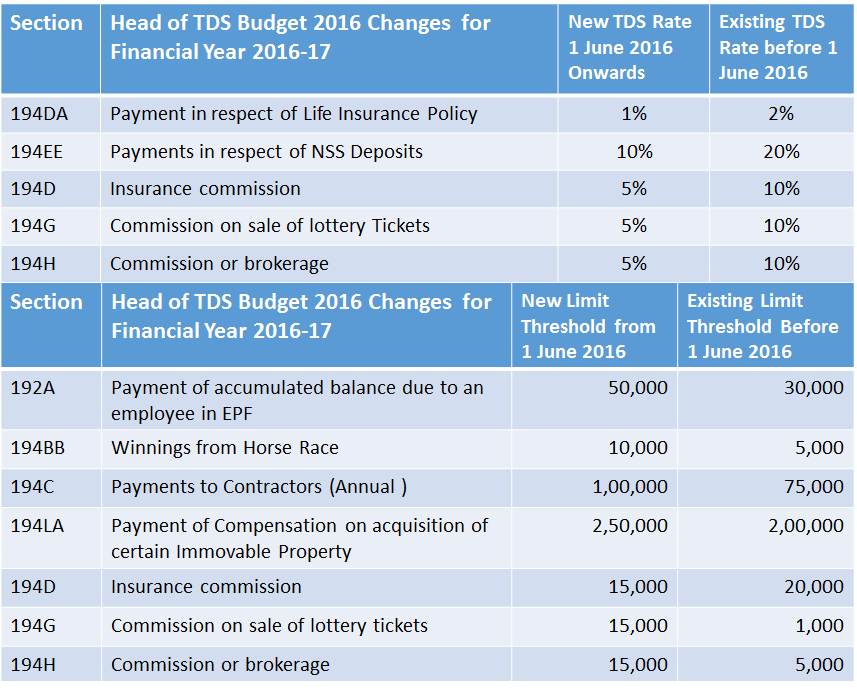

TO CA GROUPS Revised and Latest TDS Tax Deducted at Source

to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. the threshold income, which is broadly net income before tax (excluding pension contributions), is increased from £110,000 to £200,000. for other types of income, such as director’s remuneration, they may be taxed at a fixed rate of 22%. wed 2 aug 2023 19.01 edt. the rates of adjusted income and annual allowance have been updated. Maximum amount of income which is not chargeable to. Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax. What Is Threshold Income.